What Is The Overall Purpose Of Performance Bonds?

Analyzing The Specifics about Performance Bonds

Canadian contractors are forced to jump through a number of hoops, before they’re allowed to begin working and making an income. At times, these obstacles may feel like nothing more than a hindrance and this train of thought is entirely reasonable. Why should you and your company be judged and mistreated, due to the actions of others? Unfortunately, the performance bond isn’t optional. It is required by the Canadian government and must be obtained, before you begin work on the project. Below, you’ll learn about the overall purpose of the performance bond, so you can eliminate the aforementioned misconception.

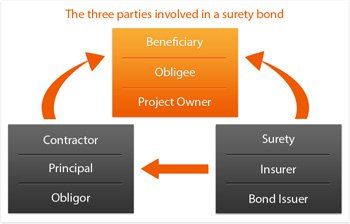

Understanding The Three-Party System

In order to fully understand the concept of performance bonds, you should take the time to learn about the three parties involved. First and  foremost, you are the one that initiates the bond. Within the arrangement, your company will be designated at the principal. The majority of the responsibilities will fall onto your shoulders. Secondly, there will be an obligee. This is the entity, which you will be working for. It could be a project owner, developer or even the local government. This group is protected from you under the agreement of the surety.

foremost, you are the one that initiates the bond. Within the arrangement, your company will be designated at the principal. The majority of the responsibilities will fall onto your shoulders. Secondly, there will be an obligee. This is the entity, which you will be working for. It could be a project owner, developer or even the local government. This group is protected from you under the agreement of the surety.

And finally, the surety is the surety company, which issued the performance bond in the first place. Generally, the surety provider will remain behind the scenes, unless they’re required to step in and negotiate complaints or conflicts.

Prevents Neglect

Whether you’re dealing with construction performance bonds, bid bonds, or license bonds, you will find that the purpose is fairly uniform. Each surety bond is required for a handful of reasons and the most notable is that they’ll help to prevent neglect and deceit. The requirement of the bond helps to prevent unreliable companies from entering into a contract with a project owner. It also helps to ensure that the contractor will fulfill their obligation, and avoid doing anything devious along the way.

Ensures Satisfaction

Another thing to remember is that the project owner or obligee is always protected in a performance bond situation. This is undoubtedly the most notable purpose of this specific type of construction bond. The bond gives the contractor a little additional initiative for getting the job done on time and in a satisfactory manner. Contractors that fail to live up to their end of the arrangement will end up facing backlash and will likely suffer from a bond claim. The bond claim could result in further losses and could hurt your company substantially!

Shows Legitimacy

As a Canadian contractor, you will likely feel that the performance bond doesn’t benefit you or your company in any shape or form. This is definitely a misconception, but it is one that is shared by the majority of contractors in Canada. The truth of the matter is that this bond can actually enhance your company’s reputation and make others more willing to engage in business with you. If you’re unable to obtain a performance bond, you can guarantee that other contractors, subcontractors, supplies, and project owners will do their best to steer clear of your company.

However, if you do obtain the bond and successfully complete the project, you will be able to prove that your company is worthy. This can help you attract new customers and begin building a solid reputation, which will only lead to additional work and more connections in the near future.

Overall

At the end of the day, the performance bond is vital and helps to protect the obligee, within the arrangement. It is also recommended you understand the cost of obtaining performance bond so you can be prepared to budget for the premium you will be charged. Remember that the obligee could be anyone or anything, including the city, a developer or the community at large. To avoid repercussions, you need to do your best to abide by the initial agreement and fulfill each and every one of the client’s requests.

Other Frequently asked questions regarding performance bonds

- How much do performance bonds cost? – 1% of the project value.

- How do I qualify for a performance bond? – We will need to review your company’s financials, past job experience, and details of the job(s) you will be bidding on.

- What is the turn around time for me to get a performance bond? – Within 24 hours of you getting awarded the job.

- How do I apply for a performance bond? – Please contact us.